“I’d love to invest, but I just don’t know how to.”

“I’d love to invest, but I just don’t know how to.”

“We want to start investing money, but we don’t know what to do or where to start.”

“I just don’t get investing.”

If you can relate to any of those statements, you’ve come to the right place. Investing money is something we’re supposed to do, right? If we want to retire, pay for our children’s college, and have our money grow, it seems like investing is our main way to get there.

It appears simple for so many people, but for others, it is an unfamiliar beast of a concept that we just can’t wrap our heads around . . .

Some people’s Step 1 of investing is another’s Step 5, so I am going to start at the very beginning and give you a step-by-step plan of attack. You may already be on Step 3 and not even know it!

How to Start Investing Money

Step 1: What Do You Want to Save For?

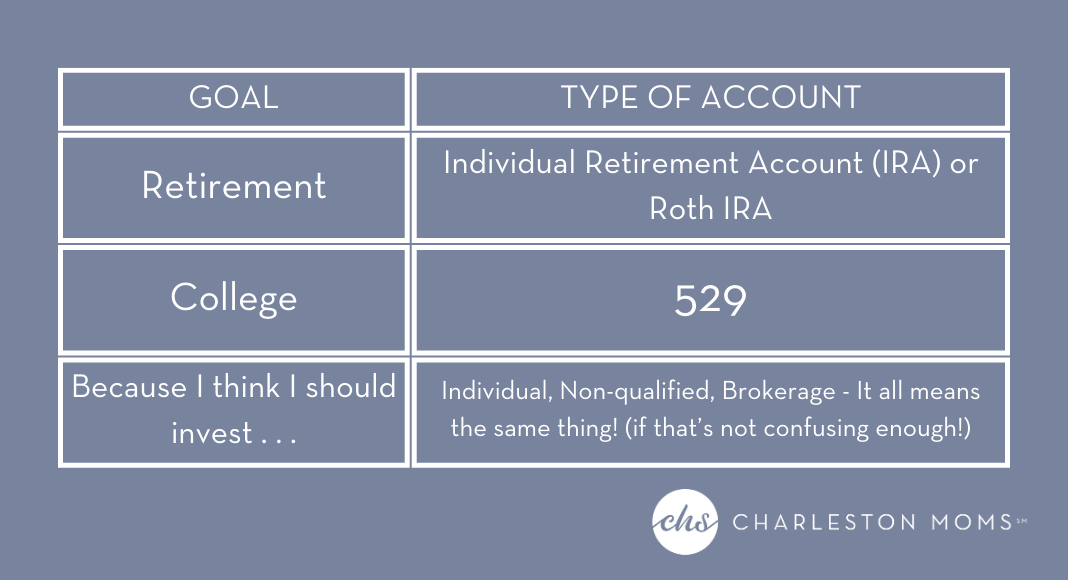

Retirement, paying for college, buying a house, the future are all correct answers. If the answer is: I feel like this is something I should be doing. That is the correct answer too! There is no wrong answer, but your reason for saving may determine the type of account you save into. Check the graphic below for some clarity.

For now, though, let’s focus on the “because I feel like I should invest” type of account.

Step 2: What Is the Cadence You’d Like to Invest?

Do you want money to come out of your checking account monthly and be invested? Or would you just like to send money to the investment account every so often?

Again, there is no wrong answer, but it helps us prepare for when we set up the account. I find having those two answers ready is helpful because we are thinking with the end in mind.

Step 3: We’re Doing This!

Etrade.com, Fidelity.com, and Robinhood.com are all good options to have your account. At these places, the “because I feel like I should invest” account is called a Brokerage account. You’ll need to put in your information to create a username and an account.

Step 4: Fund the Account

When creating your account it will ask you questions about how you’re going to fund the account. That is where you enter your bank account information, and put your dollar amount and cadence of contributions in (Step 2).

Step 5: Choose an Investment

Now that we have the account and funding information set up, you’re close but you’re still not investing. If we do nothing after this point, your money sits in cash.

You need to choose an investment. We can go in so many different directions with this one, but here’s the good news: you really can’t mess this up! Every investment is going to go up and down at any point in time, but historically, markets go up and investors make money. We may not make money every day or every year, but over the long term, we make money. Any investment is better than nothing and you can always make changes in the future.

Investment Vehicles

There are different types of investment vehicles:

- Stocks (Equities) are what usually come to mind when we think about investing. When you buy a stock, you buy shares of a company. If the company does well, has good earnings, and doesn’t have bad press, the stock value goes up and you make money. If the opposite happens, the stock goes down and you “lose” money.

- Bonds are like a loan. A town, municipality, etc. offers a bond and a % interest rate (yield). You buy their bond at a stated price and for a period of time (duration), they pay you a yield. Then when the bond matures, you get your money back.

- Mutual Funds are a bunch of stocks and bonds packaged together. A mutual fund is actively managed by portfolio managers. So all you have to do is choose the fund, and the portfolio manager takes care of the rest.

- Exchange Traded Funds (ETFs) are similar to a mutual fund in that it’s a bunch of stocks or bonds put together in a pretty package by investment firms. ETFs are not actively managed, but they’re also cheaper, generally, than mutual funds.

I personally like ETFs better than mutual funds, because they’re less expensive and you can trade them at any time. You can submit a request to trade your mutual fund at any time, but they will only be traded after the market closes.

Step 6: Decide What ETF, Stock, Mutual Fund, Etc. To Invest In

Again, at this point in the infancy of your account, we really can’t mess this up. Bankrate.com, US News Money, and Forbes all have articles and recommendations on ETFs or Mutual Funds to buy now. Don’t overthink it, just pick one of them!

You’ll see the ETF, for example, has a name and then a bunch of letters. The bunch of letters is called a ticker. The ticker is how the ETF, Mutual Fund, or Stock identifies itself. For example, the Vanguard S&P 500 ETF’s ticker symbol is VOO. You may need to enter the ticker on your investment platform (etrade, Fidelity, etc.) to choose the investment, versus entering the full name.

Step 7: Let the Magic Happen!

Now we sit back and wait. Your money will pull from your checking account and get automatically invested. You’ll start receiving statements via email letting you know how much you’ve invested, where your money is invested, and your account value.

The good thing about a brokerage account is that the money is there for you when you need it. There are no penalties you have to pay if you want to withdraw all or some of your money.

Step 8: Retirement/College Savings

If you want a retirement account or college savings account, take all the same steps, but for Step 3, you’re choosing either IRA or Roth IRA for Retirement, or 529 for college savings. But be careful, you need to use those accounts for their purpose: retirement or education. If not, you could end up paying taxes or penalties on the withdrawn amount.

These steps are the very basics of opening up an investment account. If you have employer retirement plans (401k, 403b, 457) or desire more personalized advice, I recommend you seek out a Financial Advisor to help you along the way.